The Fall Of LUNA

It’s been a wild week for Cryptocurrencies and stock markets all over the world, but the highlight was for one particular project “TERRA and LUNA” Let me try my best to explain how it all started and where we are now.

The first as we all know was the mechanism behind Terra and its stablecoin UST. The second was as all we know the general panic. People just sold into the fear in large quantities. Even though the investors were not knowing what was happening with the DE -pegging all of them pressed sell button.

Together they created what we are seeing now. The UST losing its dollar peg and LUNA crumbling to cents.

Background

If you are closely watching the projects that you do invest Anchor Protocol, Terra’s high-interest savings account, has been steadily reducing the rates it offers holders for depositing UST.

The APY of 20% attracted a lot of investors into the project, but the community voted for the proposal which meant that if Anchor’s reserves increased by 5%, the interest rate would increase. If these reserves decreased by 5%, the interest rate would also decrease. They also added that if the rate was continuously expected to drop 1.5 percentage points each month if there were more lenders than borrowers on the platform.

On April 23 more than 72% of all UST in circulation was locked up in Anchor. With interest rates expected to fall, UST’s number-one use case began to waver. Once there was clarity that the 20% is not going to remain the same UST holders started to leave.

On May 6. 2022, roughly around 14 billion UST was in the anchor protocol by May 8 this dropped to 11.7 B. Still at that time UST was holding its ground with the dollar. Even so roughly about 2.3B in capital was taken out from the project.

Since the whole eco system was revolving around Anchor and its APY, more began to move ship. The result was a “mass exit”

To exit UST the investor has two options.

The Burn & Mint mechanism

Turning to stable coin exchange curve finance.

The Burn & Mint mechanism

This would allow all users to swap 1 UST for 1 LUNA, which destroys the UST in the process. This process creates an arbitrage opportunity whenever UST falls below 1$. Traders can buy in with the discounted UST and trade it in for 1$ in LUNA, making a profit. The opposite is also true.

Turning to stable coin exchange curve finance.

Usually when a stable coin loses its peg savvy traders would go to one of the deepest liquidity pool “Curve Finance” and trade the discounted stable coin to the alternative that its pegged.

If we take the example if UST is trading at 0.99$ investors will buy the discounted UST and sell it for USDC which is 1$. That was how it all worked till this week.

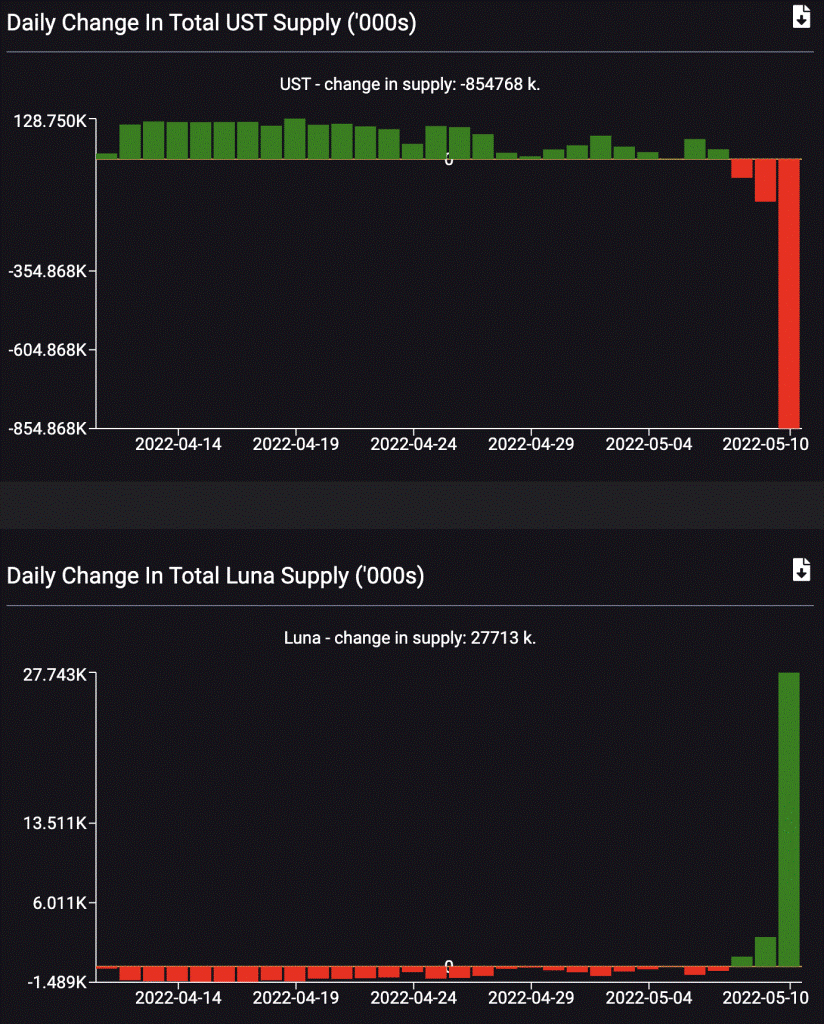

Let’s explore the Burn and Mint mechanism, the chart below shows the supply of UST cratered as it was burned, while the supply of LUNA mooned.

Source: Terra

The process was not straight forward at that time. Traders and Investors were facing were met with technical glitches. One has to keep in mind that Terra is a blockchain project and gas fees are involved with each transaction. Since more users did transactions the gas fees rose and the network was becoming instable and congested, this forced major exchanges like Binance to pause trading and withdrawals.

The burn and mint were creating effects on LUNA too, swapping and burning LUNA for UST means more LUNA is minted which increased its supply and thereby dropping the price of LUNA. LUNA reached a point where its liquidity was dried up for all the UST that was coming for the mint.

Meanwhile the Curve finance option was been used by the Anchor exits to UST against other stable coins such as USDC/ USDT. This caused the pool UST + 3Crv which also pools all the stablecoins becomes dried out of liquidity, there was more UST than any other coins in the pool, to understand it better let’s take an example.

If you sell UST for USDT you will add more UST to the pool which removes the USDT from the pool so when usually this kind of scenario happens the pool discounts the coin that is more in supply here in our example UST, hoping for traders to utilize the discount and take arbitrage positions, which would automatically rebalance the pool.

While it was usually the case as it should happen because of the supply volumes with no other coins to exchange UST supply was higher with no other tokens to balance the supply and demand equation.

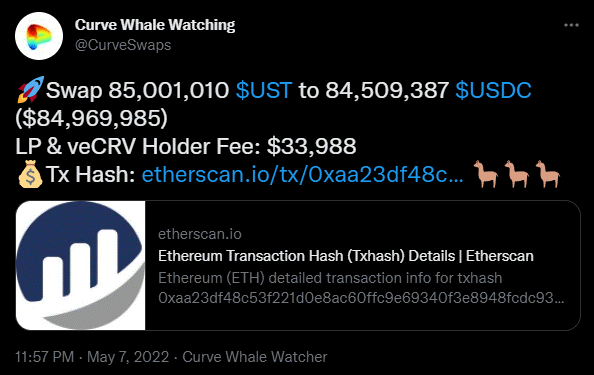

Then the inevitable happened it was caused by one whale account swapped 85 million UST for 84.5 million USDC on curve.

The balance was lost and the fall which was inevitable for LUNA and UST started what was pegged with a difference of $0.02 increased to $0.32 and took LUNA from $64 to $30. As the situation came to this point a death spiral was created which means that LUNA was not able to absorb more of UST.

The LFG (Luna Foundation Guard) had to step in at this point and dumped $216 million worth of UST into the curve pool to find its stability, they also started to deploy the bitcoin holdings that they have kept reserves for professional market maker who was essentially told to spend BTC when UST is below the peg and vice versa if it ever trades above the peg. This helped the UST to gain traction from $0.64 to $0.93 but that was very short-lived as more people tried to exit from the project. It’s also unclear if BTC peg was used to defend the peg value of UST.

All these created supply pressure for LUNA which fell to cents as of 14th May 2022. Seeing the situation getting out of hand Terra foundation stepped in to increase the supply of LUNA which only created more and more exits. To mathematically bring things into perspective On 8th May 2022 had a 343 million circulating supply. By May 12, that figure had ballooned to 32.3 billion which keeps increasing. The final outcome was UST falls $0.15 (14 May 2022) while LUNA is dust.

Trending Today

Why Should You Write a Book?

Writers Block- What is Writers Block and How to overcome Writers Block

Astrology vs. Science: Separating Fact from Fiction in the Endless Debate

55 Powerful Money Affirmations to Manifest Abundance, success and Wealth