Solana (SOL) The Dark Horse

Solana Price Prediction

Solana Price Prediction

Solana (SOL), often dubbed an “Ethereum killer,” has rapidly ascended the ranks of the cryptocurrency market since its launch in March 2020. Created by software developer Anatoly Yakovenko, Solana offers a compelling alternative to Ethereum, boasting faster transactions, lower costs, and innovative scalability solutions. Let’s delve deeper into what makes Solana unique and how it compares to Ethereum, and what would be the Solana Price Predictions.

Understanding Solana

At its core, Solana operates as a blockchain platform similar to Ethereum. However, its distinguishing feature lies in its consensus mechanism, known as proof-of-history (PoH), coupled with delegated proof-of-stake (DPoS).

PoH utilizes timestamps to order transactions, enhancing the speed and efficiency of block creation. This innovative approach reduces reliance on resource-intensive processes like mining, enabling Solana to achieve remarkable transaction throughput. On the other hand, DPoS leverages staking to validate transactions, further enhancing network security and decentralization.

Solana’s Advantages

Scalability: Solana’s blend of PoH and DPoS allows it to process transactions at lightning speed, rivaling centralized payment systems like Visa while maintaining decentralization.

Security: The PoH algorithm enhances network security by providing a verifiable record of transaction history, bolstering Solana’s resilience against attacks.

Cost-Efficiency: Compared to Ethereum, Solana offers significantly lower transaction fees, making it an attractive option for developers and users alike.

Solana vs. Ethereum

While Solana shares similarities with Ethereum, it distinguishes itself through its technical innovations and performance metrics. Here’s a brief comparison between the two platforms:

Solana’s Growth and Potential

Solana’s rise to prominence has been propelled by its vibrant ecosystem, which includes over 350 decentralized applications (dApps) and a thriving non-fungible token (NFT) marketplace. The platform’s ability to support high-speed, low-cost transactions has attracted developers and investors seeking alternatives to Ethereum’s limitations.

Moreover, Solana Labs, the technology company behind Solana, is actively developing new products like Solana Pay and the Solana Mobile Stack, expanding the platform’s utility and accessibility.

Investing in Solana

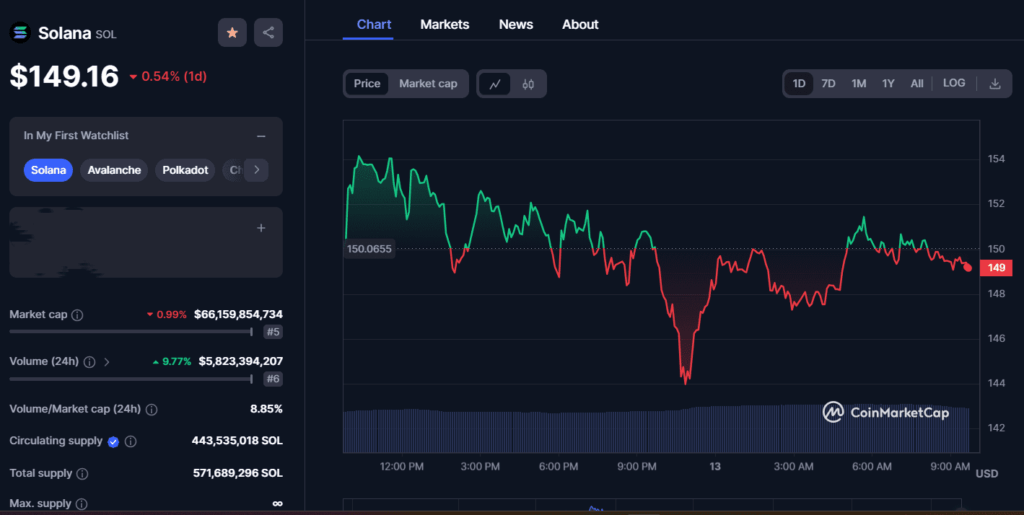

Solana entered the cryptocurrency market with a bang, conducting its initial coin offering (ICO) in April 2020 at an initial price of $US0.9511. The platform quickly gained attention for its scalability promises, leading to a meteoric rise in its token price, peaking at an all-time high of $US260 on November 6, 2021.

However, the volatile nature of cryptocurrency markets soon took its toll. The 2022 bear market saw SOL’s value plummet over 90% from its 2021 highs, exacerbated by the collapse of FTX, a major cryptocurrency exchange with ties to Solana. This event underscored the interconnected risks within the crypto ecosystem, causing SOL’s price to dip below $US10 in late 2022.

Despite these setbacks, Solana staged a remarkable comeback in the last quarter of 2023, with its price surpassing $US120 for the first time in years. This resurgence reflects not only market dynamics but also improvements within the Solana network, including enhanced stability and network uptime.

Solana Price Predicition

As we gaze into the future, Solana’s trajectory for 2024 appears optimistic, brimming with opportunities for growth and innovation. The platform’s dominance in decentralized finance (DeFi) and non-fungible token (NFT) sectors positions it as a formidable contender against Ethereum. Solana’s high throughput and low transaction costs make it an attractive platform for developers and users alike, paving the way for significant advancements in the coming year.

The Bull Case:

Solana’s success is often measured against Ethereum, the leading blockchain smart contract platform. Solana has managed to emulate Ethereum’s success in many ways, boasting a thriving ecosystem of projects, meme coins, community engagement, and active developers. Memecoin successes like $BONK demonstrate Solana’s ability to capture market hype and engagement.

Solana Price Prediction

2024 Q4 – 250$

2025 – 450$

2026- 1000$

The Bear Case:

Despite its successes, Solana faces challenges and trade-offs, particularly in balancing scalability, security, and decentralization—the blockchain trilemma. Solana’s architectural choices prioritize scalability over decentralization, raising concerns about its long-term sustainability. Ethereum’s transition to Proof-of-Stake exemplifies its ability to overcome challenges, while uncertainties surround Solana’s capacity to navigate future obstacles.

Solana Price Prediction

2024 Q4 – 150$

2025 – 250$

2026- 400$

Can SOL Reach $1000?

The prospect of SOL reaching $1000 involves speculation and uncertainty. With a total supply of 569,041,570 SOL, achieving this milestone would necessitate a market capitalization surpassing $569 billion—significantly higher than its current $45 billion market cap. While theoretically possible, it would require widespread adoption, technological advancements, and a favorable market environment.

Solana’s journey in 2024 is characterized by both promise and potential hurdles. While its ability to innovate and capture market attention bodes well for its future, challenges in scalability, security, and competition from Ethereum loom large. Investors should approach with caution, considering the risks and uncertainties inherent in the cryptocurrency market. Solana’s fate in 2024 will be shaped by its ability to navigate these challenges and capitalize on its opportunities, paving the way for a potentially transformative year ahead.

Disclaimer: It’s crucial to note that the information provided here is not financial advice. Investing in cryptocurrencies involves inherent risks, and the value of investments can be highly volatile. Cryptocurrency investments are speculative and may result in the loss of capital. Individuals considering investment decisions should conduct thorough research, carefully assess their risk tolerance, and consult with a qualified financial advisor to make informed choices based on their unique financial situation. Always be aware of the potential risks associated with cryptocurrency investments and make decisions responsibly.