It’s been a wild week for Cryptocurrencies and stock markets all over the world, but the highlight was for one particular project “TERRA and LUNA” Let me try my best to explain how it all started and where we are now.

The first as we all know was the mechanism behind Terra and its stablecoin UST. The second was as all we know the general panic. People just sold into the fear in large quantities. Even though the investors were not knowing what was happening with the DE -pegging all of them pressed sell button.

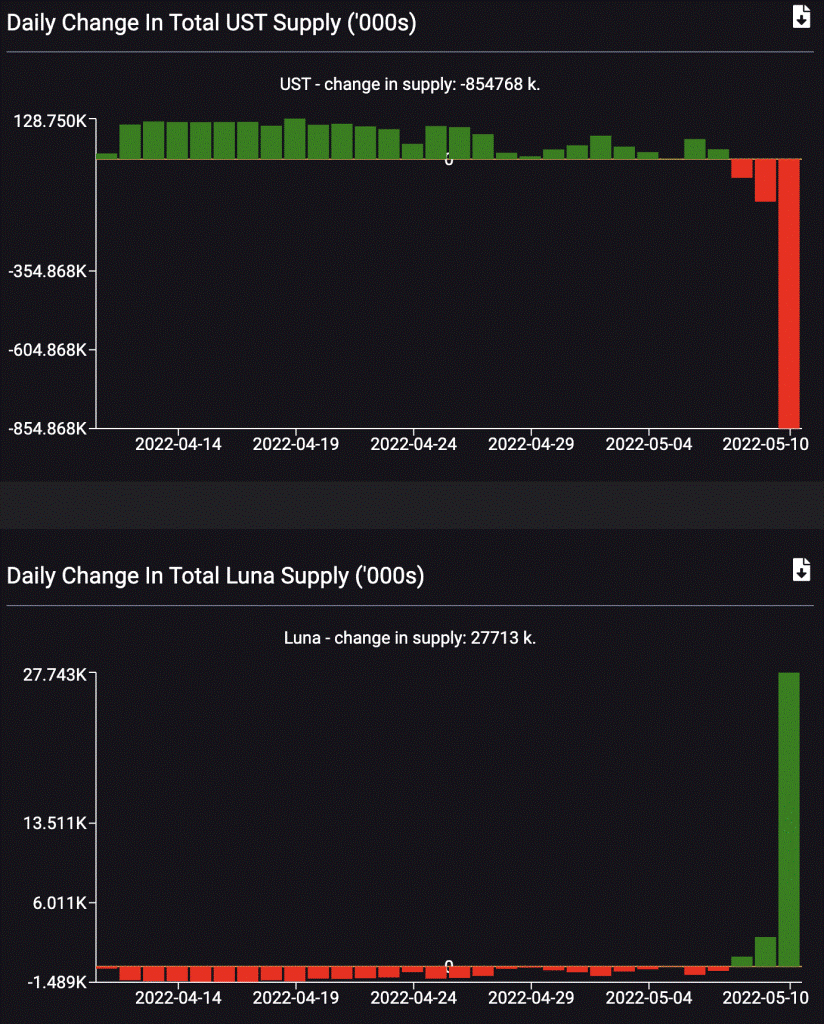

Together they created what we are seeing now. The UST losing its dollar peg and LUNA crumbling to cents.

Background

If you are closely watching the projects that you do invest Anchor Protocol, Terra’s high-interest savings account, has been steadily reducing the rates it offers holders for depositing UST.

The APY of 20% attracted a lot of investors into the project, but the community voted for the proposal which meant that if Anchor’s reserves increased by 5%, the interest rate would increase. If these reserves decreased by 5%, the interest rate would also decrease. They also added that if the rate was continuously expected to drop 1.5 percentage points each month if there were more lenders than borrowers on the platform.

On April 23 more than 72% of all UST in circulation was locked up in Anchor. With interest rates expected to fall, UST’s number-one use case began to waver. Once there was clarity that the 20% is not going to remain the same UST holders started to leave.

On May 6. 2022, roughly around 14 billion UST was in the anchor protocol by May 8 this dropped to 11.7 B. Still at that time UST was holding its ground with the dollar. Even so roughly about 2.3B in capital was taken out from the project.

Since the whole eco system was revolving around Anchor and its APY, more began to move ship. The result was a “mass exit”

To exit UST the investor has two options.

The Burn & Mint mechanism

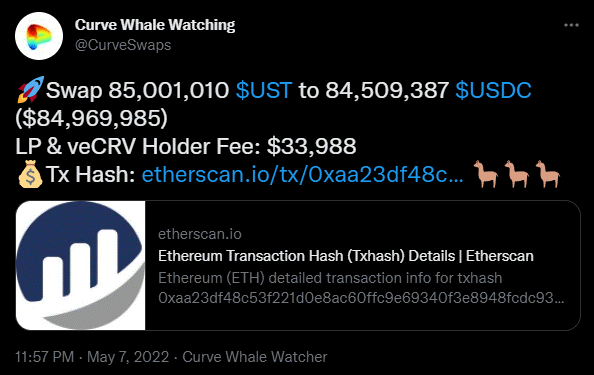

Turning to stable coin exchange curve finance.